Your insurance coverage deductible quantity is something you will identify with your insurance coverage representative or service provider prior to settling your auto insurance coverage plan. You ought to have the alternative to change your deductible at any type of time. What sorts of car insurance coverage deductibles are there? Your car insurance plan is a bundle of various insurance coverages (business insurance).

Various other insurance coverages such as extensive, collision, personal injury security and uninsured vehicle driver residential or commercial property damage exist to assist cover injuries to those in your lorry as well as damages to your cars and truck. These coverages might have deductibles, or at least the alternative to consist of an insurance deductible to minimize the expense of insurance coverage.

g., utility pole, guard rail, mailbox, building) when you are at-fault. While accident protection will certainly not compensate you for mechanical failure or normal wear-and-tear on your auto, it will cover damage from holes or from rolling your automobile (auto). The average price of collision coverage is normally around $300 annually, according to the Insurance Info Institute (Triple-I).

This includes fire, flooding, criminal damage, hailstorm, falling rocks or trees and also other dangers, such as hitting a pet. According to the Triple-I, the typical expense of comprehensive protection is typically less than $200 per year.

This insurance coverage is not readily available in every state, yet it may have a state-mandated deductible quantity in those where it is. In cases where an insurance deductible applies, it is normally reduced, in between $100 to $300. Accident protection, Depending upon your state, you may have accident security (PIP) insurance coverage on your policy (vehicle insurance).

It can likewise help cover expenses connected to lost wages or if you need a person to do house jobs after a crash due to the fact that you can not do so. Relying on your state, you may have an insurance deductible that uses if filing an insurance claim under this coverage. Lots of states with PIP deductibles supply a number of options to select from, and the deductible you choose can impact your costs.

An Unbiased View of What Is A Car Insurance Deductible? - Kelley Blue Book

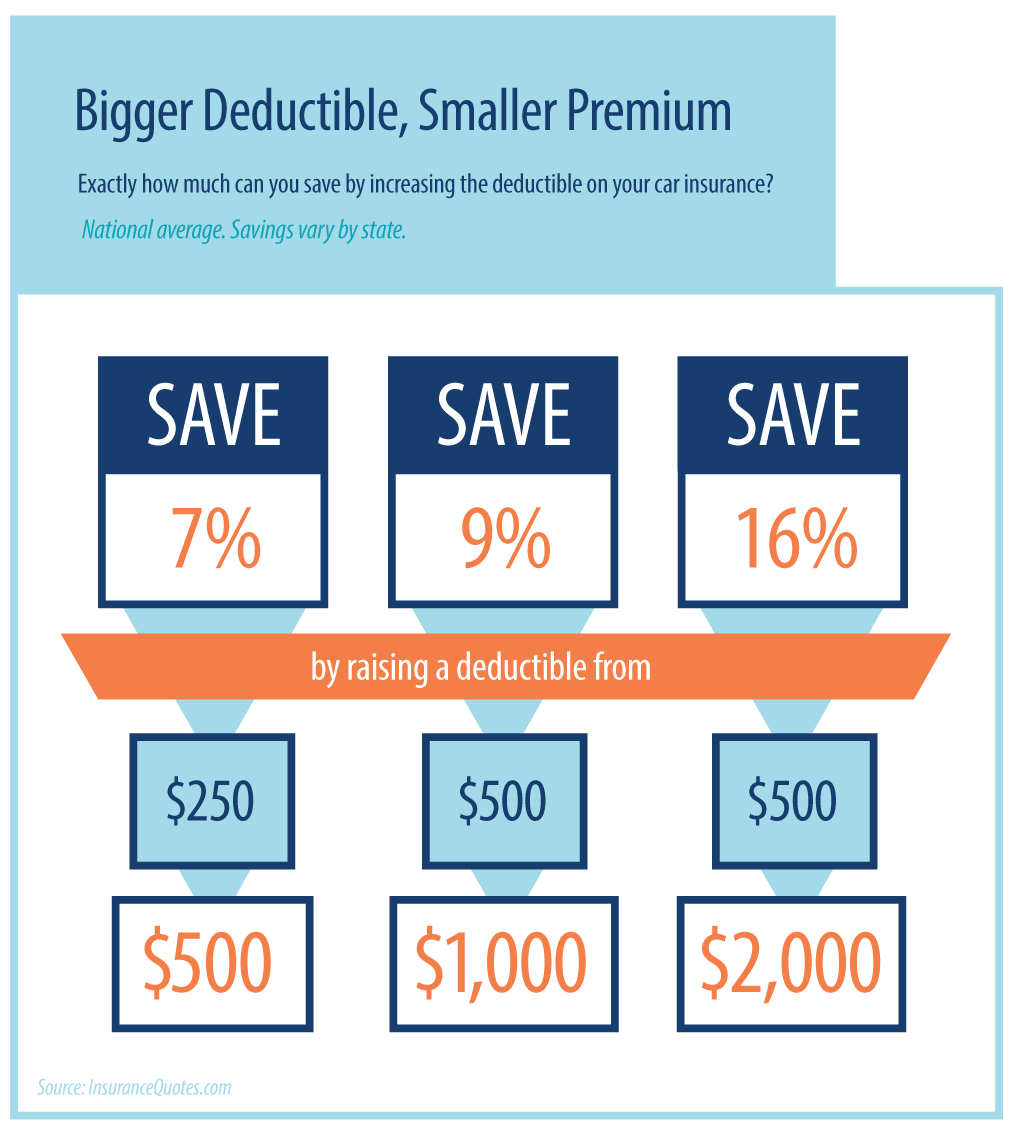

Most business offer options for $250, $500, $1,000 or $2,000 deductibles. Some car insurance business supply various alternatives for deductibles, including a $0 or $100 insurance deductible. Your thorough and crash coverages do not need to match, either; it is not unusual to have a $100 extensive insurance deductible yet a $500 crash insurance deductible, or a $500 extensive insurance deductible and also $1,000 accident insurance deductible.

Typically, the reduced the insurance deductible, the higher your insurance coverage costs. It is essential to consider your overall financial wellness when selecting an insurance deductible. Variables to consider when selecting an auto insurance coverage deductible, There are a number of points to think about when choosing your car insurance policy deductible amount. We have covered a few of them here: Do you wish to pay much less for auto insurance coverage or fixings? A higher deductible will usually lower your insurance premium, but you will certainly pay greater out-of-pocket prices if you sue for damage to your vehicle.

You might invest much more on your premium by having a reduced deductible and also never ever finish up filing an insurance claim. Before you select a deductible, it is important to figure out what you can afford to pay if your auto is damaged in a mishap. cheap insurance.

If you do, you may not have the ability to pay for to repair your lorry if you are at fault and also require to pay the deductible for fixings. Does your loan provider have deductible requirements? If your automobile is funded or rented, you will possibly require to carry extensive as well as crash protections for your lorry.

Some loan providers will have a maximum deductible that you are allowed to carry for thorough as well as accident. When are you not required to pay your car insurance policy deductible?

Your deductibles just use when filing a case with your insurance provider. If you have a decreasing deductible, Some insurance provider provide a lessening insurance deductible, or vanishing insurance deductible, choice. If you have this plan function, the longer you go without a crash leads to a decrease in the amount you would need to spend for your deductible.

The Buzz on What Is A Disappearing Deductible? - Mapfre Insurance

So, for instance, if you have a $500 crash deductible as well as do not have a mishap for four years, you might obtain a $100 decrease every year. Then, if you needed to sue, your insurance deductible would certainly be $100 instead of the original $500. Once you use your lessening deductible, there is typically a time period to get approved for it once again.

Regularly asked questions, What does it indicate when you have a $1,000 collision deductible? If you have a $1,000 deductible, you will pay $1,000 expense if you have actually an approved case covered under collision. If you submit a case for $5,000 well worth of fixings, you will pay $1,000 and the insurance coverage company will pay $4,000 - car insurance.

Your physical injury liability as well as residential or commercial property damages responsibility will pay for the damages to the various other party, and also those protections do not have a deductible. If you have accident coverage and you want the insurance coverage business to tip in to cover the fixings to your automobile, you will certainly have to pay your accident insurance deductible (cheap).

If the mishap was the other driver's mistake, their responsibility insurance coverage ought to spend for your problems and also you should not need to pay an insurance deductible. auto. If the various other vehicle driver is without insurance or underinsured, you may be liable for paying an insurance deductible depending on exactly how your coverage uses to cover the costs (money).

Your insurance provider will spend for your problems, minus your insurance deductible, and then ask the at-fault driver's insurance firm to pay the cash back in a process called subrogation. low cost.

Your cars and truck insurance policy deductible is usually a collection quantity, claim $500. If the insurance policy insurer determines your case quantity is $6,000, and you have a $500 deductible, you will obtain a claim repayment of $5,500. Based on your deductible, not every automobile accident warrants a claim. If you back right into a tree causing a small dent in your bumper, the cost to repair it might be $600.

The Ultimate Guide To Auto Deductible Reimbursement - - Why Hopesouth

Deductibles vary by policy and also vehicle driver, and you can select your car insurance policy deductible when you buy your plan.

Compare quotes from the top insurance firms. Which Automobile Insurance Policy Protection Kind Have Deductibles? Equally as there are various kinds of auto insurance protection, there are varying deductibles based on those various kinds of insurance coverage. insure. It's vital to recognize exactly how much the automobile insurance coverage deductible is for Click here for more info every type, so you'll recognize what you're expected to pay in the event of a claim.

Liability cars and truck insurance policy coverage does not have a deductible. This insurance coverage pays your expenditures if your cars and truck is harmed by something besides a collision with another car or object. money. This might consist of fixing damages from hailstorm, hitting a deer or changing a cracked windshield. It also will pay to cover the cost of changing swiped items.

This coverage pays for repair work to your vehicle when you are at fault. affordable car insurance. This might be when your cars and truck is harmed in a mishap with one more lorry or a things such as a tree or wall. This deductible is generally the highest possible deductible you will certainly have with your car insurance plan.

In that situation, you would certainly not pay a crash deductible. Injury defense insurance coverage pays the medical costs for the driver and also all guests in your auto. Without insurance driver protection pays your costs when you are in an auto mishap with a driver that is at mistake but does not have insurance coverage or is insufficiently insured to cover your expenses - insurers.

What Is the Ordinary Deductible Price? Since customers pick differing types of automobile insurance protection with different monetary limits, deductibles can vary substantially from one driver to the following (insured car). For many motorists, normal insurance deductible quantities are $250, $500 and also $1,000. According to Money, Nerd's information, the average cars and truck insurance coverage deductible amount is roughly $500.

4 Easy Facts About What Is A Deductible In Car Insurance? - Fox Business Shown

Also, your auto insurance deductible will differ based upon that coverage and the expense of your premium. Normally speaking, if you choose a policy with a greater deductible, your costs will certainly be reduced. This can be a terrific alternative as long as you can pay that greater deductible in the event of a crash (perks).

You can conserve an average of $108 per year by increasing your insurance deductible from $500 to $1,000. For those with tight budgets, picking a lower premium as well as a higher insurance deductible can be a way to guarantee you can pay for your automobile insurance coverage. If you can manage it, paying a higher costs can imply you do not have to come up with a lot of cash money to pay a lower insurance deductible in the occasion of an accident.

It's essential to have your concerns concerning automobile insurance coverage deductibles addressed before that takes place, so you know what to anticipate. When there's a car mishap, the at-fault chauffeur is called for to pay the auto insurance policy deductible.